Need to consolidate debt? See our review of Discover Personal Loans. Get $2.5K-$40K with $0 origination fees. Check your rate with no credit score impact.

Discover Personal Loan Review [2025]: $0 Fees from a Name You Trust?

Let’s be honest. You probably have a Discover card in your wallet. You know the brand, you know their customer service, and you (hopefully) enjoy their cash-back rewards.

But what about your other credit cards? The ones from Visa, Mastercard, or store brands that have crept up to a 25% or 30% APR? That debt is a heavy weight, and it’s hard to get ahead.

You could apply to a new fintech app, but that means trusting a new company with all your data.

What if you could get a $0-fee debt consolidation loan from the brand you already know?

That’s the exact promise of a Discover Personal Loan. It’s designed for people with good credit who want to simplify their finances with a brand they already trust.

We’ve done a deep dive into their offer. If you have good credit (680+ FICO) and are tired of high-interest debt, this review is for you.

What Makes a Discover Personal Loan Different?

In the world of “good credit” loans, there are three main players: SoFi, Marcus, and Discover. All three compete on one massive promise: $0 Fees.

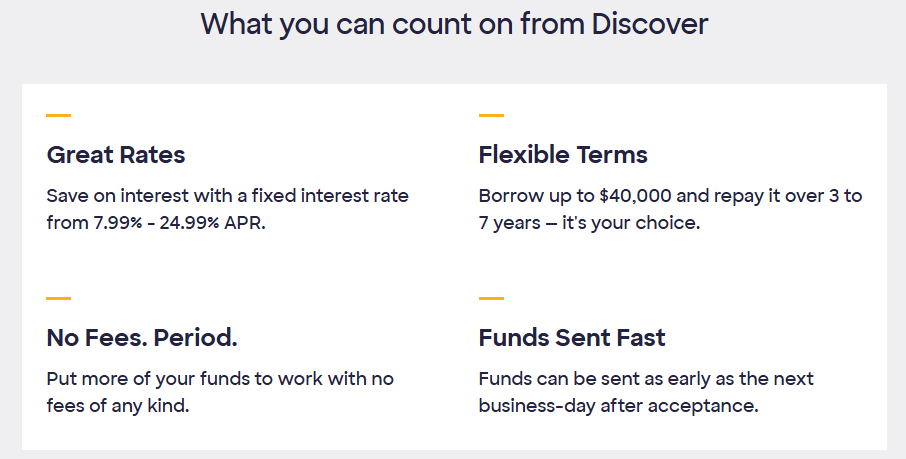

Like its competitors, a Discover loan has:

- $0 Origination Fees: You keep 100% of your loan. If you borrow $25,000, you get $25,000.

- $0 Prepayment Penalties: You can pay your loan off early—in full or in part—any time you want with no fee.

But Discover has two key advantages that set it apart:

Potential Same-Day Funding: This is a huge speed advantage. If you are approved, Discover can often send the funds to your bank account the very same day.

Brand Trust & Simplicity: You know who they are. You’re not just a number in a new app; you’re a customer of a major, established US financial company.

100% US-Based Customer Service: When you call with a question, you talk to a real person, based in the US. This is a huge, underrated benefit.

The 3 “Pains” a Discover Loan Solves Immediately

A loan is a tool. It’s only good if it solves a specific problem. Here’s where Discover excels:

1. The Pain: “I’m Drowning in Credit Card Debt.”

The Solution: Simple, Trusted Debt Consolidation This is their #1 use. You have $20,000 in debt across three different high-interest cards. You get a Discover loan for $20,000, pay them all off (you can even have Discover send the funds directly to the creditors), and you’re left with one, fixed-rate payment that’s almost certainly lower.

2. The Pain: “I Need to Fund a Major Purchase (Home, Wedding, Vacation).”

The Solution: Fast, No-Fee Funding You need $30,000 for that kitchen remodel or $15,000 for a wedding. A Discover loan is a simple, unsecured way to get that cash. With $0 origination fees and funding as fast as the same day, it’s often a much smarter and faster move than a home equity loan.

3. The Pain: “I’m Frustrated with Automated Chatbots and Offshore Call Centers.”

The Solution: Real, Human Customer Service Your finances are important. When you have a question, you don’t want to argue with a robot. Discover’s commitment to US-based loan specialists provides a level of peace of mind that many new “fintech” apps simply can’t match.

Discover Loan Features: A Deep Dive

Let’s look at the hard numbers from their official site.

- Loan Amounts ($2,500 to $40,000): A very solid range. The $2,500 minimum is great for smaller needs, and $40,000 covers most debt consolidation or projects.

- APRs (7.99% to 24.99%): This is highly competitive for a no-fee loan. These fixed rates are exactly why you use this to pay off your 29.99% credit card.

- Loan Terms (36 to 84 months): This gives you incredible control. You can choose a 3-year term to get out of debt fast, or a 7-year (84-month) term to get the absolute lowest monthly payment possible.

- $0 Fees: $0 origination fee and $0 prepayment penalty.

- Fast Funding: You can receive your funds as fast as the same day if you’re approved and accept the terms by a certain time.

Who is a Discover Loan For? (And Who Should Skip It?)

Trust is built on honesty. Discover is not for everyone.

✅ This loan is perfect for you if:

- You have Good-to-Excellent Credit (Typically a FICO score of 680 or higher).

- You want to consolidate high-interest credit card debt.

- You HATE fees and want a $0 origination fee loan.

- You trust established, mainstream brands and want US-based customer service.

❌ You should probably look elsewhere if:

- You have “Fair” or “Bad” Credit (a score below 680). You will likely be denied. (A lender like Upgrade or Upstart is your best bet).

- You need to borrow more than $40,000. (A lender like SoFi offers up to $100,000).

- You need to borrow less than $2,500.

How to Apply: The 3-Step Process

Discover’s process is fast, online, and secure.

- Check Your Rate (The “Soft Pull”): This is the first step. You click our link, go to the secure Discover site, and fill out a short form. This does not affect your credit score.

- Review Your Offers: In as little as 60 seconds, Discover will show you what you pre-qualify for. You’ll see the loan amount, the APR, and your monthly payment options (from 3 to 7 years).

- Accept & Get Funded: If you like an offer, you’ll proceed to the full application, verify your information, and e-sign your loan agreement. You can get your funds as fast as the same day.

FAQs

-

What credit score do I need for a Discover loan?+

Discover is designed for borrowers with good to excellent credit. While they don’t state a hard minimum, you will have the best chance of approval and getting a low rate with a FICO score of 680 or higher.

-

Does Discover really have no fees?+

Yes. This is their main selling point. There are no origination fees (to start the loan) and no prepayment penalties (to pay it off early). They do, however, charge a late fee if you miss a payment.

-

Will checking my rate affect my credit score?+

No. Discover uses a “soft credit pull” (or soft inquiry) to show you your pre-qualified offers. This has zero impact on your credit score.

-

How fast do I get my money?+

It’s one of the fastest. After you are approved and accept your loan, Discover can send the funds to your bank account as fast as the same day.

-

Can Discover pay my credit cards off for me?+

Yes. Like some other top lenders, Discover gives you the option during the application to send your loan funds directly to your other creditors, simplifying the debt consolidation process.

Our Final Verdict

For the good-credit borrower, a Discover Personal Loan is an A-tier choice, standing right alongside SoFi and Marcus.

It has the same $0-fee promise as its top competitors, but it wins on brand familiarity and customer service. If you’re the kind of person who wants to know they can talk to a real, helpful person in the US, Discover is for you.

If you trust them with your credit card, you can absolutely trust them to help you get out of debt.

Chase Personal Loan Review: No Longer Offered? (And 3 Better Alternatives for 2025)

Chase Personal Loan Review: No Longer Offered? (And 3 Better Alternatives for 2025)  Avant Personal Loan Review [2025]: The Best Loan for Fair Credit?

Avant Personal Loan Review [2025]: The Best Loan for Fair Credit?