Your Upgrade Personal Loan: The Final Step

You’ve done the research. You know that paying 25%+ APR on your credit cards is a dead end. You also know that your “fair” credit score (600+) is the only thing that’s been holding you back.

You are in the right place. Upgrade is built for you.

This is the final step. From here, you will be transferred to the official, 100% secure Upgrade website to check your personalized rate.

Remember, the #1 benefit of this next step is:

Checking your rate is 100% FREE and will NOT affect your credit score.

You have nothing to lose by looking.

What Happens When You Click? (A 100% Transparent Process)

We believe in total transparency. When you click “CHECK MY RATE NOW,” you are leaving this review site and being transferred to the official, secure Upgrade application portal.

Here is the simple, 3-step process you will follow:

Step 1: The 60-Second “Soft Pull”

You will land on Upgrade’s secure page. You’ll fill in some basic information. When you submit this, Upgrade runs a “soft credit pull.” This has zero impact on your FICO score.

Step 2: See Your Personalized Offers

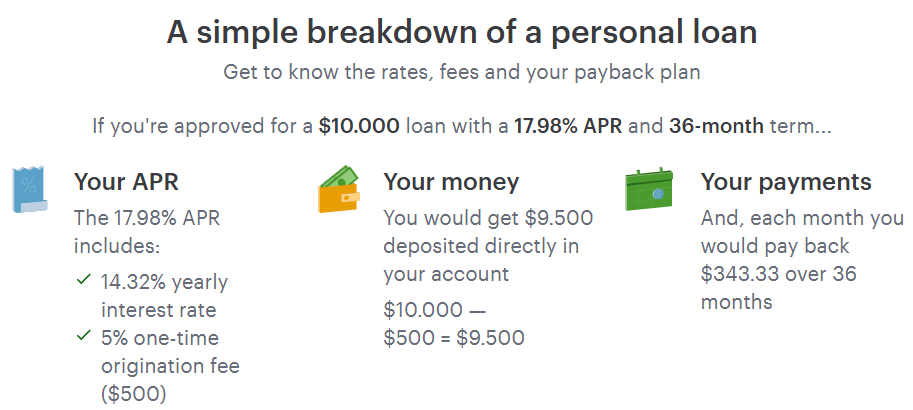

Based on that soft pull, Upgrade will show you the loan options you pre-qualify for. You will see:

- Loan Amounts: (e.g., “Up to $20,000”)

- Your APR: (Your interest rate)

- Your Origination Fee: (The fee is shown upfront)

- Your Monthly Payment: (You can adjust the loan term)

Step 3: Accept & Get Funded (Only if You Love Your Offer)

If you see an offer that saves you money, you can accept it. This is where you can choose their best feature:

- Have the funds sent directly to your credit card companies; OR

- Have the funds sent to your personal bank account.

The choice is yours.

Reminder: Why You Are Making the Right Choice

In case you have any last-minute doubts, remember what you are fixing today:

- You Are Beating the “Denial”: Upgrade is built to say “yes” to the 600-720 FICO score range that other lenders ignore.

- You Are Automating Your Finances: The “direct-to-creditor” payment option is a game-changer. It takes the guesswork out of debt consolidation.

- You Are Getting a Fixed Rate: You are trading your high, variable-rate credit card debt for one, predictable monthly payment.

This isn’t just a loan; it’s a tool to rebuild.

Chase Personal Loan Review: No Longer Offered? (And 3 Better Alternatives for 2025)

Chase Personal Loan Review: No Longer Offered? (And 3 Better Alternatives for 2025)  Avant Personal Loan Review [2025]: The Best Loan for Fair Credit?

Avant Personal Loan Review [2025]: The Best Loan for Fair Credit?